What’s the minimal many years importance of a reverse home loan? Constantly, 62. Prior to you earn this kind of mortgage, find out about the risks, and imagine other options.

Contrary mortgage loans usually are reported as an ideal way for money-strapped old property owners and you can retired people to get spending money versus being required to throw in the towel their homes. Always, minimal years getting criteria an opposing home loan is 62. In some instances, you might be able to get you to definitely if you’re more youthful, like, shortly after turning 55.

But they are these mortgages all that high? Opposite mortgage loans is actually complicated, high-risk, and you may expensive. Plus of several circumstances, the financial institution is foreclose. Taking a contrary financial constantly isn’t best, even though you meet the minimum age needs.

Exactly how Contrary Mortgages Really works

With an other home loan, you’re taking out that loan resistant to the security of your home. Unlike having an everyday financial, the lending company makes costs for you with a contrary mortgage.

The borrowed funds should be paid down after you pass away, flow, import identity, or offer the home. not, for those who breach brand new terms of the loan offer, the lender you will telephone call the borrowed funds due earlier.

Just in case you never pay back the loan because the financial boosts it, you could eradicate the property in order to a foreclosure.

Household Collateral Conversion process Mortgage loans

The brand new Federal Homes Administration (FHA) insures HECMs. So it insurance rates positives the financial institution, maybe not brand new citizen. The insurance kicks within the if the debtor defaults towards www.availableloan.net/installment-loans-ne/eagle the financing as well as the domestic isn’t really value enough to pay off the financial institution entirely compliment of a foreclosure profit or some other liquidation procedure. This new FHA makes up the lending company towards losings.

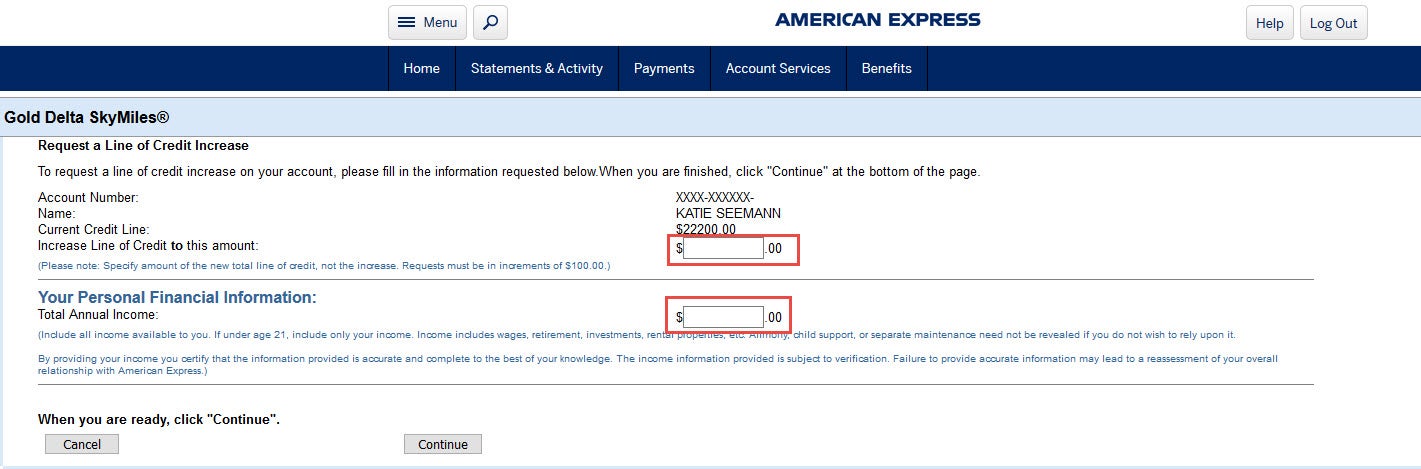

To locate an excellent HECM, you ought to see rigorous criteria to have recognition, also at least many years requirements. You might discovered HECM money within the a lump sum (at the mercy of specific constraints), because monthly payments, because the a personal line of credit, or because a combination of monthly installments and you may a type of borrowing from the bank.

Exclusive Reverse Mortgage loans

Proprietary reverse mortgage loans aren’t federally covered. This opposite mortgage will be a good « jumbo reverse home loan » (merely individuals with quite high-value belongings get him or her) or some other brand of reverse mortgage, including one targeted at someone years 55 and over.

Other types of Opposite Mortgage loans

A different type of opposite home loan are a « single-use » contrary home loan, which is also called a good « deferred payment loan. » This reverse mortgage was a want-dependent mortgage to have another type of goal, instance expenses property fees otherwise investing in home fixes.

Opposite Financial Years Standards and you can Eligibility

Once again, minimal age requirement for an excellent HECM opposite home loan was 62. There’s no upper age limit to track down a good HECM contrary financial.

Contrary mortgage loans do not have borrowing from the bank or money criteria. The amount you could obtain will be based upon your own residence’s worth, current rates, as well as your ages. Together with, just how much of the home’s well worth you can extract was limited. By 2022, many money provided with an excellent HECM is $970,800. And, a borrower may get merely 60% of mortgage within closing or in the initial 12 months, subject to a few conditions.

- You ought to live in the house or property since your prominent residence.

- You really must have good collateral about property otherwise own brand new home outright (meaning, you don’t have a mortgage with it).

- You simply cannot feel delinquent for the a national obligations, particularly government taxes or government student education loans.

- You need to have money available to spend constant assets costs, instance house maintenance, possessions fees, and homeowners’ insurance.

- Your home should be within the great condition.

- The property need to be a qualified assets style of, for example an individual-home.