That’s everything from your delivery partners, to utilities and broadband internet, right through to rent for your premises. You can use your financial data to budget and plan your restaurant’s long-term success. Next, set up a chart of accounts, which is a system that organizes your restaurant’s accounts into categories, such as assets, liabilities, income, and expenses. This method is usually best for restaurant accounting because you have to regularly track your inventory, and it gives you a more accurate view of your financial situation.

- Bookkeepers are more task-based and manage accounts payable, payroll, and posting journal entries.

- Managing varying tax rates, exemptions, and reporting mandates across different jurisdictions demands meticulous attention to detail.

- It also allows restaurant owners to concentrate on the reason they got into the business in the first place.

- Liabilities are things like vendor bills and restaurant equipment loans.

- Analyzing financial reports such as profit and loss statements, balance sheets, and cash flow statements empowers informed decision-making.

What are the fundamental financial metrics for reviewing a restaurant’s economic performance?

Although It can be more complex to work on, the accrual method is the most widely used. Although there are many options, most restaurant and retail businesses choose the calendar year accounting period. Restaurants usually run seven days a week and might have some days with more sales.

Related Cost Guides

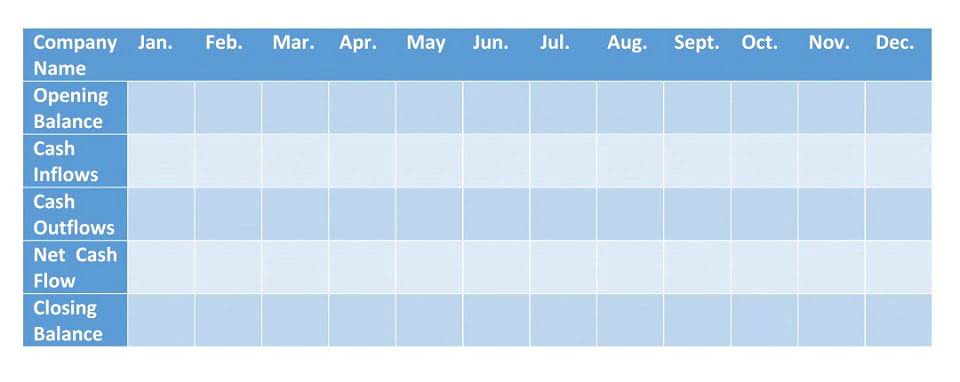

Accounts payable are what you owe to vendors, etc., for the products or services they provide. Restaurant owners need to track when a bill is received, when it’s due, and whether it gets paid on time. Paying your bills on time will avoid late fees, which are an additional expense for your restaurant that can be avoided. A cash flow statement is a report that records all the incoming and outgoing cash for a specific period. It lets you see where your money is going and where it’s coming from and ensures you have enough flowing each way.

Restaurant Bookkeeping 101: A Guide to Accounting Basics

The next restaurant accounting area you’ll need to pay attention to is the expenses. Tracking expenses monthly and even weekly helps you understand how you can improve and cut down spending. It helps you better understand your finances, decrease expenses, increase profits, and gives you insights into your performance. Under accrual accounting, CoGS is recorded as inventory is used, not when the suppliers are paid.

As an event, it’s more of an overall umbrella and is “co-located” at the city’s ExCeL Centre with Cloud Expo Europe, Big Data & Ai World, Data Centre World, Cloud & Cyber Security Expo, and more. Following hot on the heels of CES, February’s annual Mobile World Congress (MWC) in Barcelona is the world’s biggest and most influential mobile tech event. For those who find Vegas too in your face, it’s also the ideal conference to attend, as the Catalan setting means the vibes are way more relaxed than they are on the Strip. Kicking things off every year, the annual Consumer Electronics Showcase (CES) in Las Vegas is the absolute glitziest tech event around. With more than 4,300 exhibitors and 135,000 attendees, the 2024 edition may be in the books but such is the demand around CES that you should already be thinking about booking for CES 2025.

Great food, brilliant customer service and all-round stellar dining experiences are probably why you got into restaurants in the first place. Aside from providing a structure to keep track of your finances, the benefits of utilising a chart of accounts are wide-reaching. The number of accounting periods a restaurant has depends on the type of accounting period it follows. If your restaurant follows the accounting period, which is recommended, you’ll have 13 accounting periods in a year. Here is the ultimate list of restaurant business KPIs you’ll lose sleep over.

How to Understand a Balance Sheet for Small Business

If you’re in search of a firm that specializes in restaurant intricacies and understands your unique challenges, don’t hesitate. Schedule a 15-minute call with us at Patrick Accounting to explore if we are the perfect fit for your business. You need to analyze your menu and identify your most profitable and popular items. You also need to eliminate or modify your least profitable and unpopular items. The only reason not to pursue a free trial would be if you can only afford a pricing plan for which you forgo the trial. You’ll lose more money investing in a poor software fit than if you pay a bit more for a top-quality platform.

- You would then have a payment approver approve any bills they want to be paid at anytime.

- The program includes self-teaching workbooks that prepare you to pass the CB exam.

- With these tips in mind, you can become an expert at restaurant bookkeeping in no time!

- Most restaurants accept credit cards and settle the batch on a daily basis.

- We work with many software manufacturers and can offer you ways to operate business better.

- It’s a tool for a valuing a restaurant and gauges a restaurant’s earning potential.

You need to track sales to know how your restaurant performs financially. Tracking revenue will give you a better idea of what’s the most profitable and what brings in the most money. The restaurant accountant plays a pivotal role in ensuring the restaurant’s success. They work closely with the owner to develop a business plan and budget, setting the financial foundation for success. It takes a sound bookkeeping system to keep track of your restaurant’s finances.

Working with tax preparation accountants who specialize in the restaurant industry can help mitigate the risk of tax-related issues and maximize available deductions. In this guide, we will walk you through the fundamental principles of restaurant bookkeeping and accounting, offering you an easy-to-follow roadmap to keep your financial records in order. It’s best practice to reconcile accounts payable before inputting invoices into bookkeeping for restaurants your accounting software. To do this, you can try a process called the “Three-Way Match.” To begin, view your restaurant’s purchase order, then the receiving order, and lastly, the vendor invoice. Connecting your accounting software to your POS will automate the collection and organization of transactions and financial data. Along with your POS, it will help you keep a close watch on your financial performance in real-time.