Nonprofits for example InCharge Construction Counseling has actually borrowing from the bank advisors who do work so you can alter your borrowing and see for folks who qualify for down percentage guidelines.

To put it briefly that if you have to individual a good domestic, a created one might be the route to take.

- Term is generally 2 decades

- Lowest down-payment was step 3.5%

- Restrict mortgage getting family and additionally home: $ninety five,904

- Credit history should be a lot more than 580

- Future client can also be suppose their financial at the interest rate

- Fees: step one.75% from cost, fee every month from .85%

Virtual assistant Funds

Pros Administration (VA) financing try another way to get a produced household. In order to be considered you need to be an assistance representative or experienced.

This type of funds is to possess are built belongings in fact it is linked to a permanent basis to the home that is owned by the new debtor. When you are purchasing the home and you can belongings together it must be your primary quarters.

- Overview of potential borrowers’ work history, credit rating, possessions and you will earnings.

- Restrict loan words.

- 1% money payment.

- Restriction amount borrowed is 95% of the bought worth.

Chattel Finance

A chattel financing can be used to order moveable personal possessions, which are often put on homes the new borrower doesn’t own. Often a good chattel loan is utilized having items like airplanes, vessels, cellular or manufactured house and you can ranch gadgets.

Chattel loans having are available house are smaller than basic house loans because the you’re not buying the home. This may build financing easier for certain because they’re credit reduced money.

But not, the brand new fees attacks are shorter – 15 otherwise two decades – that may end in highest monthly payments. However you will very own your house less complicated than just that have a 30-12 months mortgage towards a fundamental family.

Another disadvantage is the fact interest levels might be highest into chattel money. A survey by Individual Economic Shelter Agency found that the latest apr, otherwise Annual percentage rate, is actually step one.5% higher to the chattel finance than simply standard mortgages. Mortgage operating charges, however, was basically 40-50% down.

Fannie mae & Freddie Mac

![]()

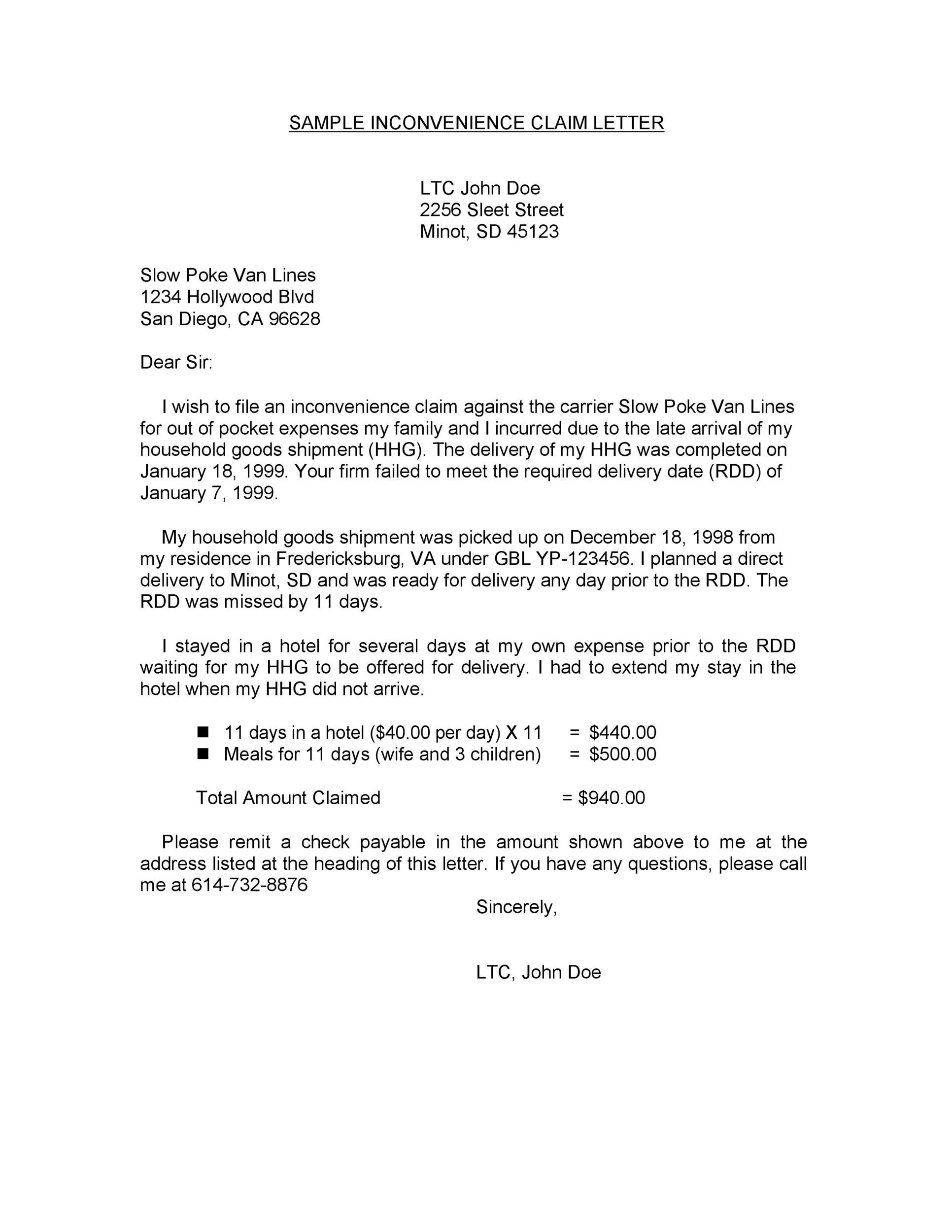

Some lenders render Fannie mae or Freddie Mac finance. Fannie mae fund was three decades, which have a down payment only step 3%. Freddie Mac computer is actually a very conventional financing having a predetermined-speed financial and you will cost in 15, 20 or 30 years, or on the a great seven/step one otherwise ten/1 changeable-rate home loan. Such as Federal national mortgage association, Freddie Mac computer fund is present which have as low as step three% off.

Fannie mae money is acquired from the MD https://paydayloanalabama.com/uriah/ Advantage System, which gives funds within straight down rates than old-fashioned are formulated property finance. Certification tend to be establishing the house which have a garage. Our home must see specific construction, framework and you may show standards.

Freddie Mac computer finance break through this new Freddie Mac computer House Possible financial system. Oftentimes, grant money can be used for the latest down payment.

The most significant destination ‘s the rates. The typical national price of an alternate are made residence is $81,700, because mediocre federal price of a new webpages-dependent domestic sold in 2020 was $287,465, according to HomeAdvisor.

The expense to have are created house are different significantly depending be it a great single broad (throughout the $54,100000 to possess another type of one to), double-large (regarding $104,100000 the brand new) or multiple-greater ($150,000 or more).

Versus old-fashioned residential property, they are distinctly less costly. However, contrary to you to character, cellular residential property are not necessarily cheap or value in a beneficial Hank Williams Jr. track. The state of the fresh are manufactured family ways made a great progress means.

To see what resource terms and conditions you could get to get good are made home, first thing you need to do is actually remark your credit history. The higher your credit score are, the more likely you are to help you qualify for greatest mortgage terms and conditions.