All of that being told you, you can find period where borrowing up against the 401k ‘s the best bet. Check out popular instances.

In case the desire in your debt is large (approaching double digits), and you can you’ve already looked trying to find a lower rate with your creditor, following good 401k loan can help you save currency and spend your debt out of shorter.

- Make certain that you are in a place the place you won’t work at your debt right up once more. This means you have created a budget giving to have unanticipated expenditures as well as have a crisis finance positioned or perhaps in procedure. Paying higher obligations having an excellent 401k mortgage just to discover your self running up the financial obligation once again makes your even more serious from, so invest in no more the fresh new loans up until you are completely personal debt-free.

- Make sure to are able to afford the fresh payment. Due to the fact 401k money typically have a limit of 5 decades or faster, you might find the loan fee getting higher than their minimum financial obligation money. Make sure you are able to afford the latest hit towards cash flow, or you might wind up accumulating a whole lot more obligations so you’re able to stay afloat.

You desire cash easily

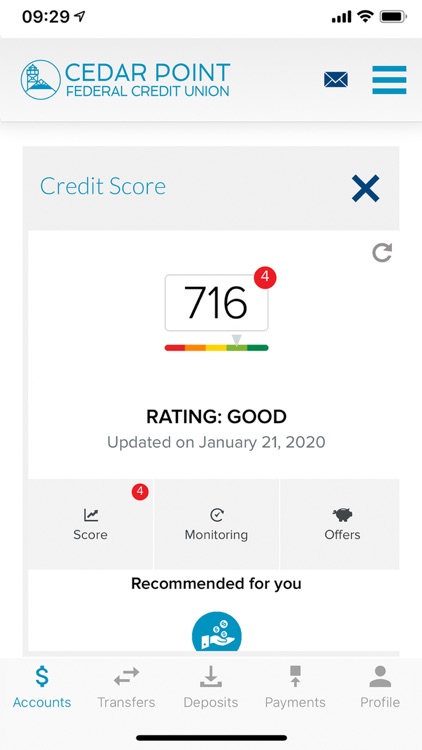

As mortgage was safeguarded by your old-age bundle balance, youre basically operating since your own lender. This means zero credit score assessment. Including, the mortgage cannot show up on credit file, and that avoids affecting your credit rating.

- Agree to expenses it back immediately. Many people acquire off their 401k for the intention of investing it off quickly, instance whenever university fees arrives in a few days, nevertheless the college loans may not be during the up until next month. Avoid the attraction in order to pull it stretched and you may adhere to your brand spanking new plan to prevent regrets.

- Make sure you acquire enough to set yourself upwards for very long-label achievements. In the event your factor in credit is actually dire like you are in likelihood of defaulting on the figuratively speaking (which usually do not disappear completely within the case of bankruptcy) or you might be against eviction otherwise foreclosure, consider borrowing from the bank adequate to hold you more where city, as well as some extra to create away getting upcoming problems. This one helps you end a vicious loop off crisis loans recuperation drama, an such like.

If you’re inside a circumstance for which you need cash easily, eg a medical crisis otherwise an university fees statement which is owed just before brand new funds are located in, following a 401k loan will help connection this new pit when you look at the a good pinch

Extremely 401k arrangements offer expanded fees conditions for the money borrowed for a new family get. While the property is anticipated to boost within the value over the long-label and you can getting sufficient down can keep your own home loan interest down, that one produces plenty of sense just like the a swap-of to possess remaining the cash spent to own old age.

- Simply acquire what you need. You’re going to have to complete closure data files in order to support the offered pay-right back big date, thus make sure you happen to be merely borrowing what you are probably going to be putting off with the your brand-new domestic purchase. Steer clear of the temptation to make use of your retirement to pay for other expenditures such as moving costs and you can the latest chairs.

- Be sure to is it really is be able to get property. Beyond having an advance payment, it’s also wise to keeps a decent disaster fund, And domestic restoration/solutions discounts set aside, if you don’t, that is also high-risk regarding a move for your requirements during the this aspect. If Mcmullen loans the buying a house are a financial continue, and also you end losing your residence, you will dump your own down-payment that’ll connect with pension.